Introducing: Competitor Intelligence for Everyone

Every once in a while, a product comes along that changes how you work. Something that gives you a new superpower, you try it once and wonder what you ever did without it. We’ve been working on a product like …

Every once in a while, a product comes along that changes how you work. Something that gives you a new superpower, you try it once and wonder what you ever did without it. We’ve been working on a product like …Read

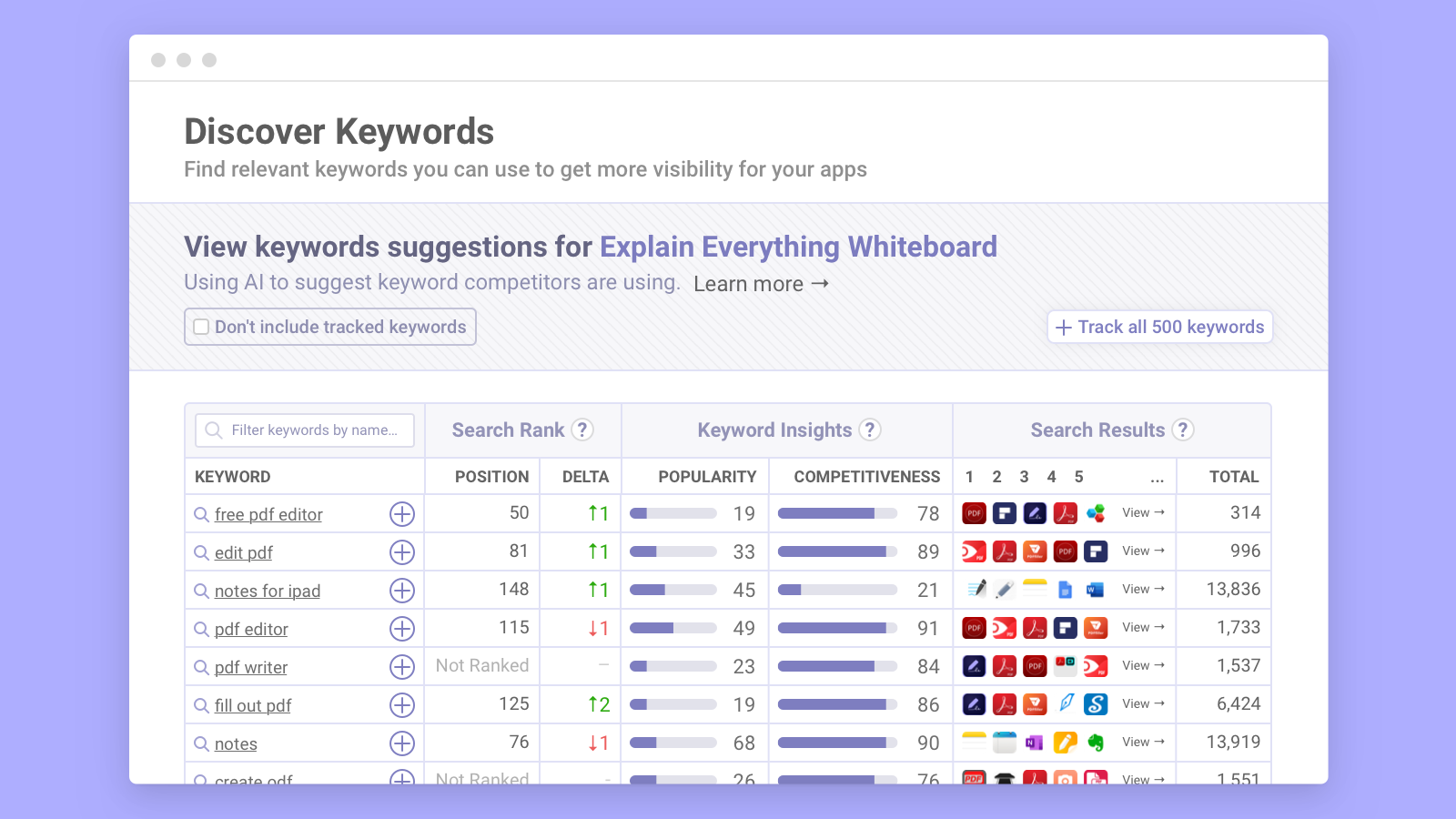

Managing Keywords Just Got a Lot Easier!

It’s been a year since we rolled out our ASO tools, and so far, thousands of developers and marketers have leveraged them to improve their ASO on the App Store and Google Play and gain both visibility and downloads. What’s …

It’s been a year since we rolled out our ASO tools, and so far, thousands of developers and marketers have leveraged them to improve their ASO on the App Store and Google Play and gain both visibility and downloads. What’s …Read

The App Store is Launching in 20 New Countries

Apple has recently announced that starting this week, the App Store will expand to 20 new countries, including: Afghanistan Bosnia and Herzegovina Cameroon Cote d’Ivoire Democratic Republic of Congo Gabon Georgia Iraq Kosovo Libya Maldives Montenegro Morocco Myanmar Nauru Rwanda …

Apple has recently announced that starting this week, the App Store will expand to 20 new countries, including: Afghanistan Bosnia and Herzegovina Cameroon Cote d’Ivoire Democratic Republic of Congo Gabon Georgia Iraq Kosovo Libya Maldives Montenegro Morocco Myanmar Nauru Rwanda …Read

New: iPad Support for Keyword Ranks, Suggestions, Research, and Competitor Tracking

Did you know that Apple ranks apps in search results differently when searching from an iPad vs. an iPhone? That’s because not all apps are available across both devices, and also because apps that work great on the iPad may …

Did you know that Apple ranks apps in search results differently when searching from an iPad vs. an iPhone? That’s because not all apps are available across both devices, and also because apps that work great on the iPad may …Read

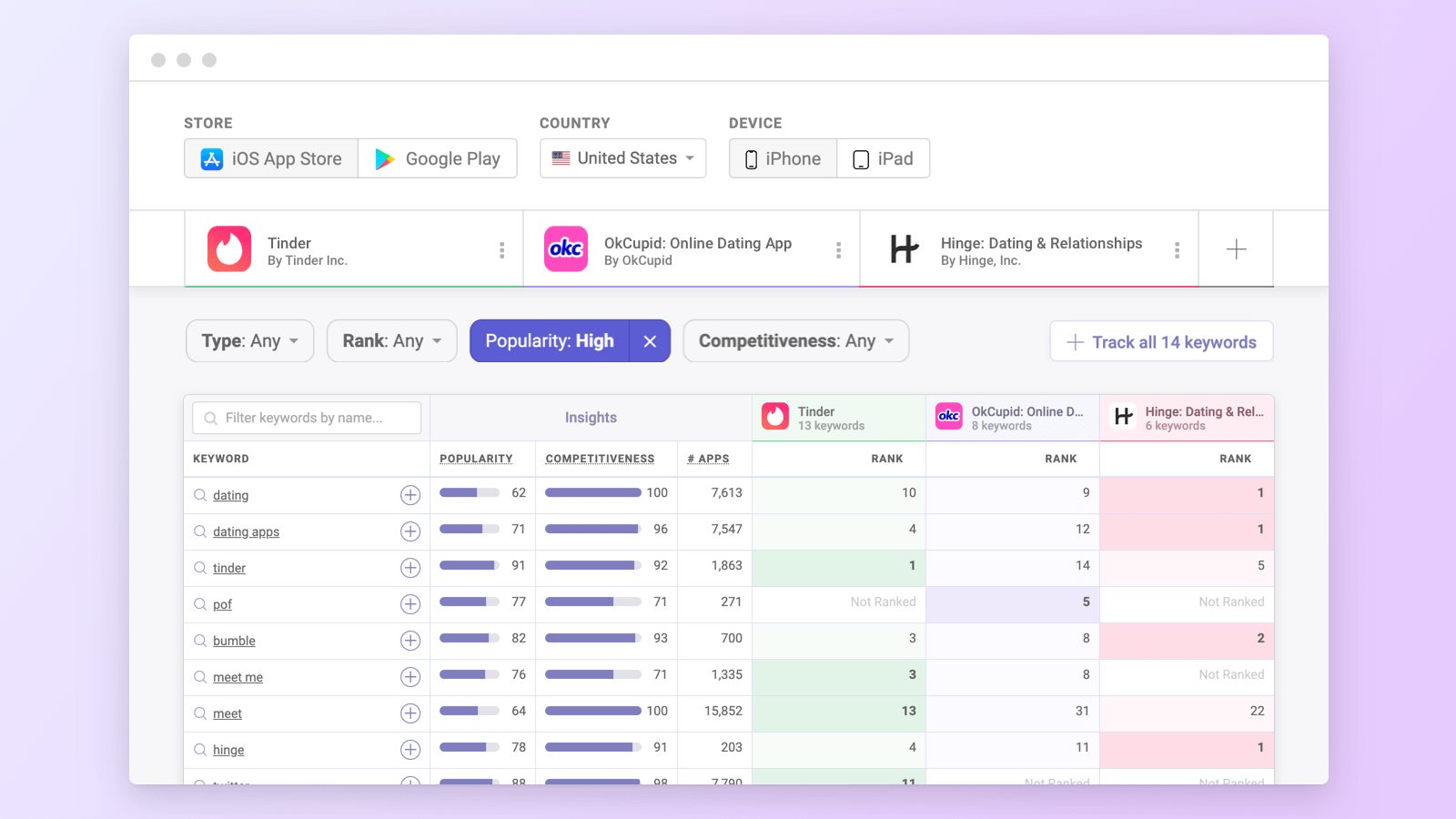

Benchmark & Learn from Competitors’ Keyword Performance

App Store Optimization can be extremely effective at increasing your downloads and revenue, but to do it right you need access to high quality data. Answering questions like “which keywords are competitors using?” or “how popular are those keywords?” can …

App Store Optimization can be extremely effective at increasing your downloads and revenue, but to do it right you need access to high quality data. Answering questions like “which keywords are competitors using?” or “how popular are those keywords?” can …Read

An Update About COVID-19

Like most companies, we’re all adjusting to life during this pandemic. Since we’re based in New York City, we started working from home last week. All of our teams, from support to data science, are 100% online, and we expect …

Read

Read

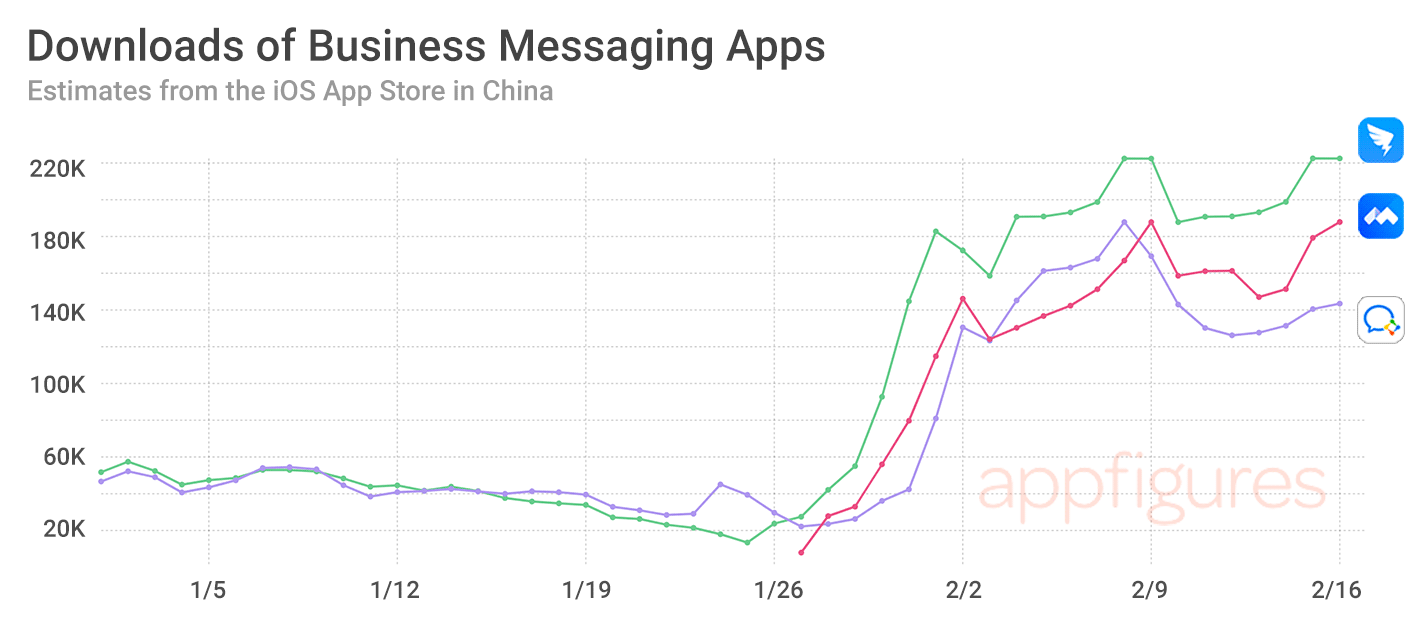

App Store Downloads Show China’s Workforce is Working From Home

Much of China’s massive workforce has been grounded since the novel coronavirus hit the country, forcing companies across the country to shut down temporarily. Looking at App Store download trends however we can see many workers are starting to work …

Much of China’s massive workforce has been grounded since the novel coronavirus hit the country, forcing companies across the country to shut down temporarily. Looking at App Store download trends however we can see many workers are starting to work …Read

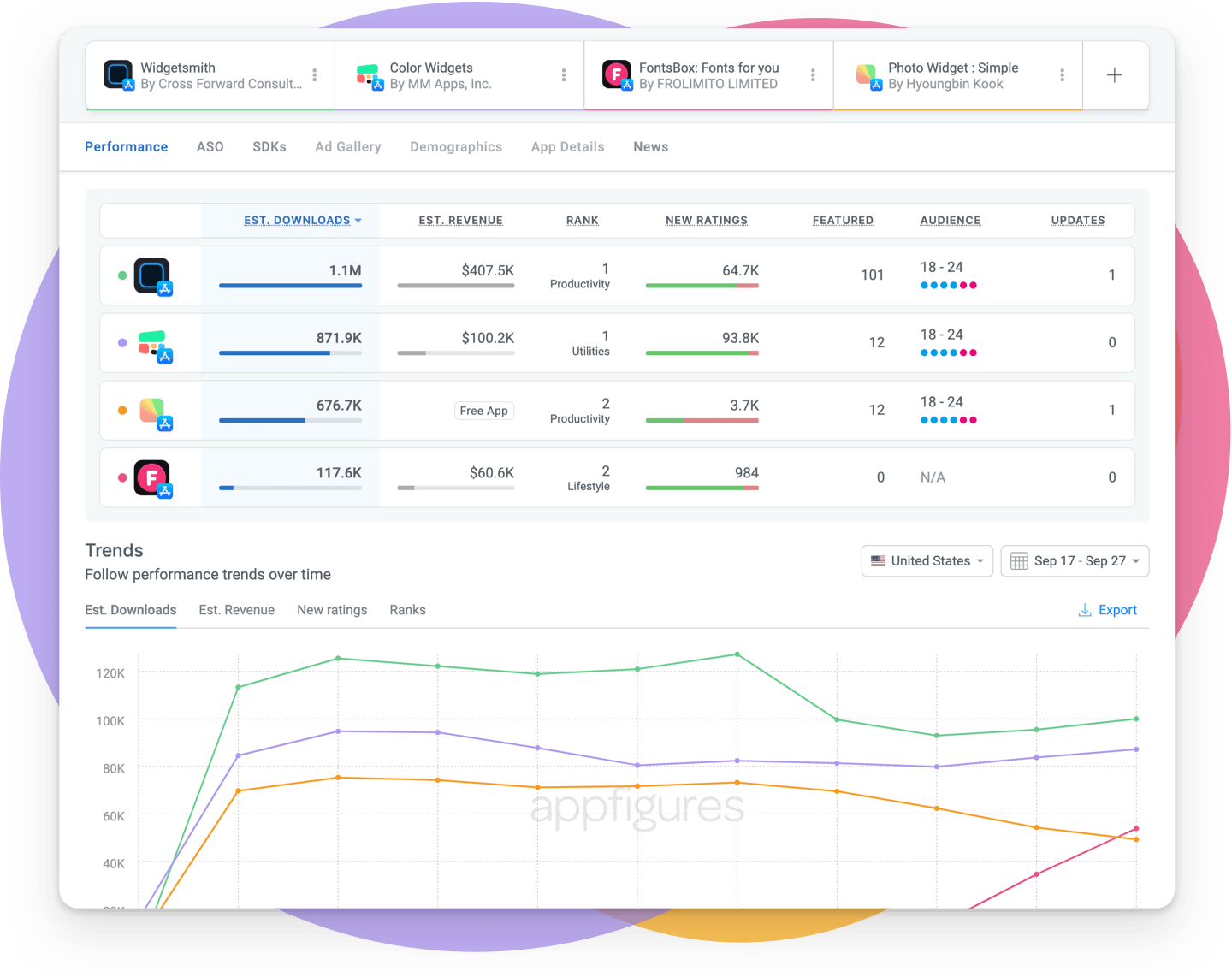

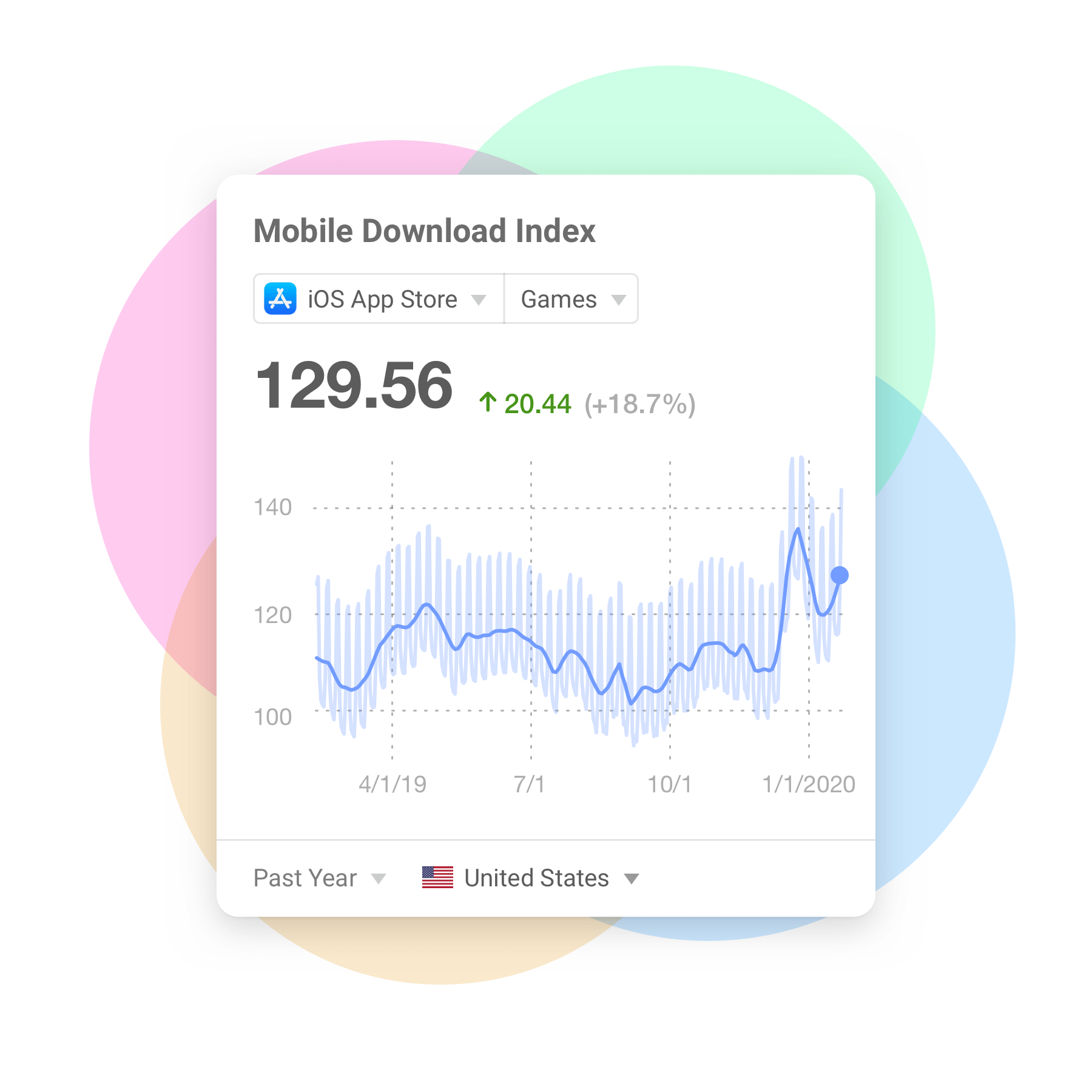

Benchmark Your Downloads with Real Market Intelligence for Free — Introducing the Mobile Download Index

Have you ever looked at your app downloads and wondered how they compare to the market? If so, you’re certainly not alone. Being able to put your performance metrics in context can make all the difference when you’re investing time …

Have you ever looked at your app downloads and wondered how they compare to the market? If so, you’re certainly not alone. Being able to put your performance metrics in context can make all the difference when you’re investing time …Read

Introducing Smart Keyword Suggestions for App Store Optimization

When it comes to discovery on the App Store and Google Play ASO has become a very effective (and free) way to get in front of more users and earn more downloads. ASO relies on finding the right keywords, which …

When it comes to discovery on the App Store and Google Play ASO has become a very effective (and free) way to get in front of more users and earn more downloads. ASO relies on finding the right keywords, which …Read

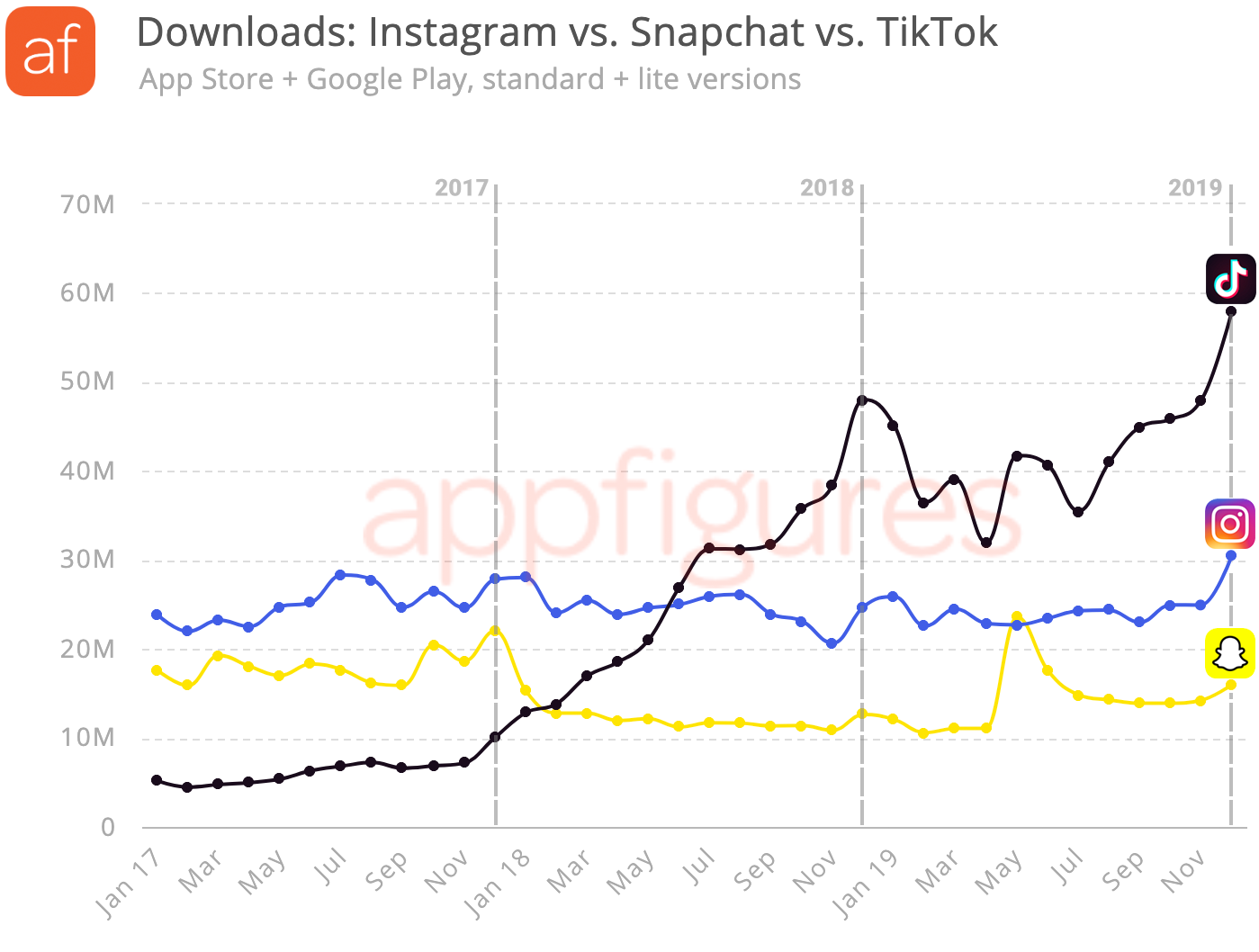

TikTok is Proving that All Publicity is Good Publicity

TikTok, the mobile video sharing app that’s been taking over social media, has been in the news a lot lately. And not in a positive way. The Chinese-based app and its developer have been accused of spying for the Chinese …

TikTok, the mobile video sharing app that’s been taking over social media, has been in the news a lot lately. And not in a positive way. The Chinese-based app and its developer have been accused of spying for the Chinese …Read