Category: Databits

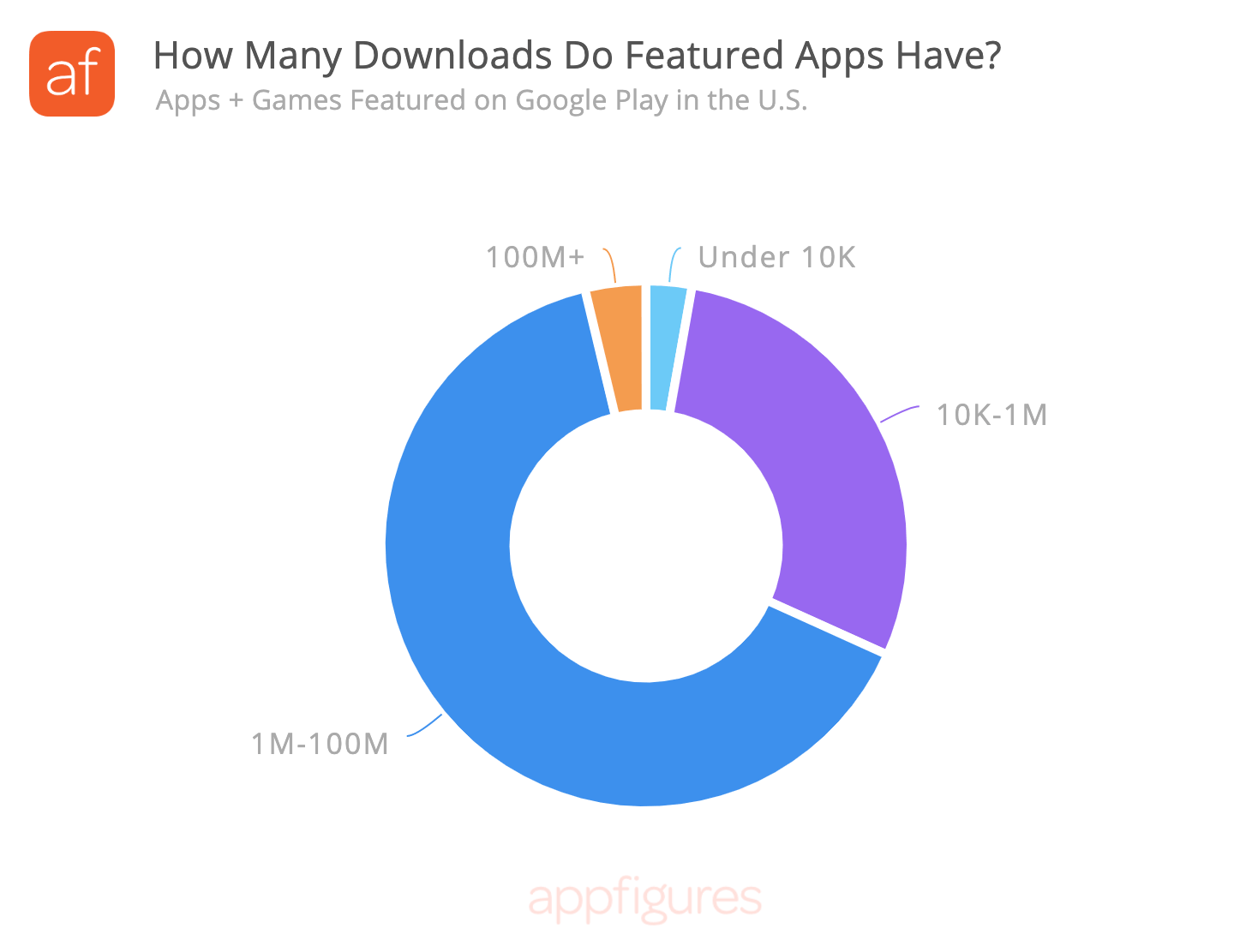

What Kind of Apps and Games Get Featured on Google Play?

Getting featured on Google Play is something every Android developer would like to experience, but it isn’t something you can just ask for or pay for. In fact, many developers don’t know what makes Google feature an app. To shed …

Getting featured on Google Play is something every Android developer would like to experience, but it isn’t something you can just ask for or pay for. In fact, many developers don’t know what makes Google feature an app. To shed …Read

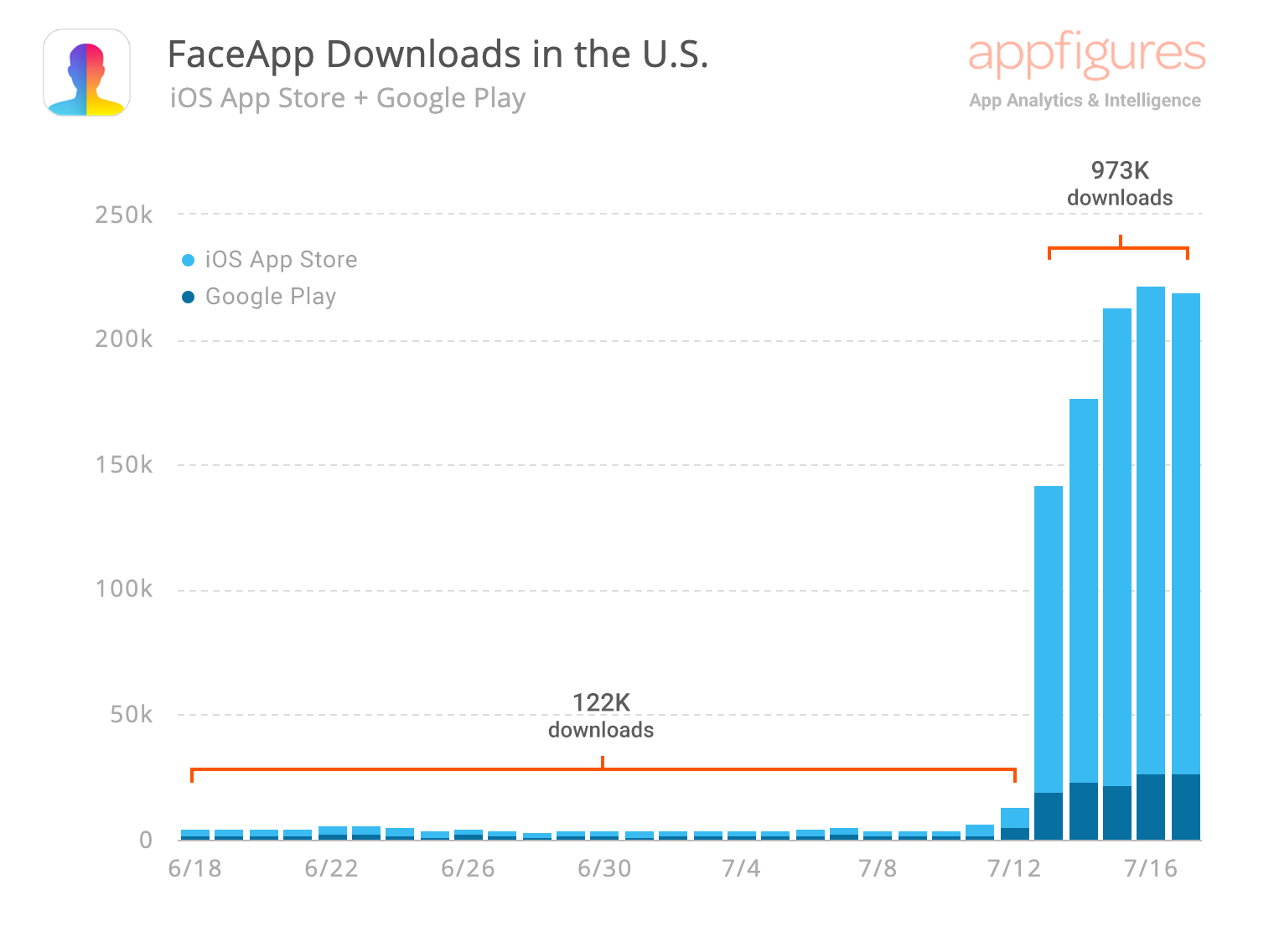

This is What Going Viral Looks Like – The Numbers Behind FaceApp

FaceApp has been in the news a lot this week. The seemingly magical AI face morphing app went viral earlier this week, resulting in a meteoric rise in Top App charts. Let’s take a look at the numbers behind FaceApp. …

FaceApp has been in the news a lot this week. The seemingly magical AI face morphing app went viral earlier this week, resulting in a meteoric rise in Top App charts. Let’s take a look at the numbers behind FaceApp. …Read

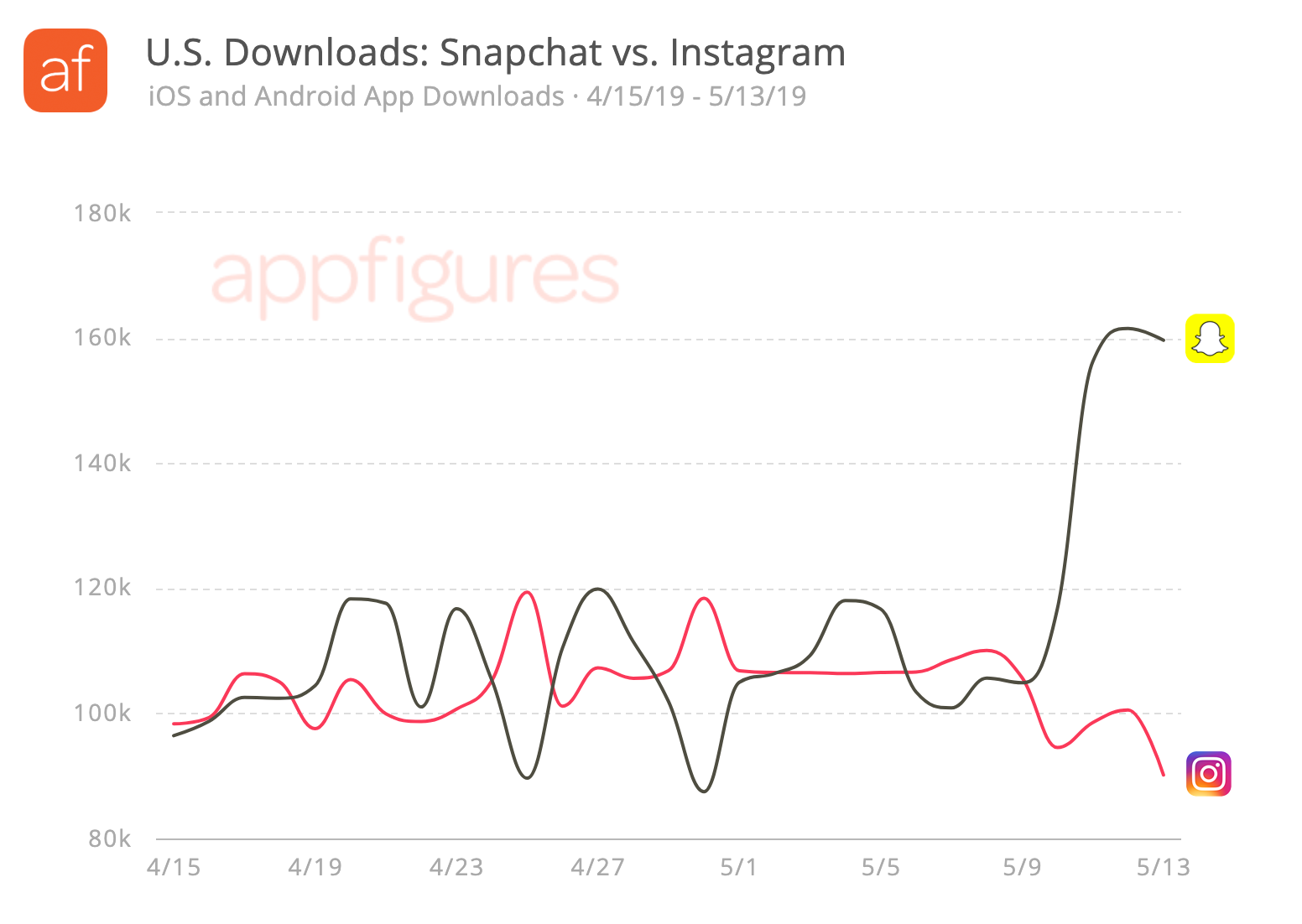

Snapchat’s Gender Swap Filters = 41% More Downloads

Last week Snapchat introduced new filters that blur the gender line and reminded those of us who dismissed the app after its failed redesign and poor public performance what it’s still good at — creating a delightful selfie experience. The …

Last week Snapchat introduced new filters that blur the gender line and reminded those of us who dismissed the app after its failed redesign and poor public performance what it’s still good at — creating a delightful selfie experience. The …Read

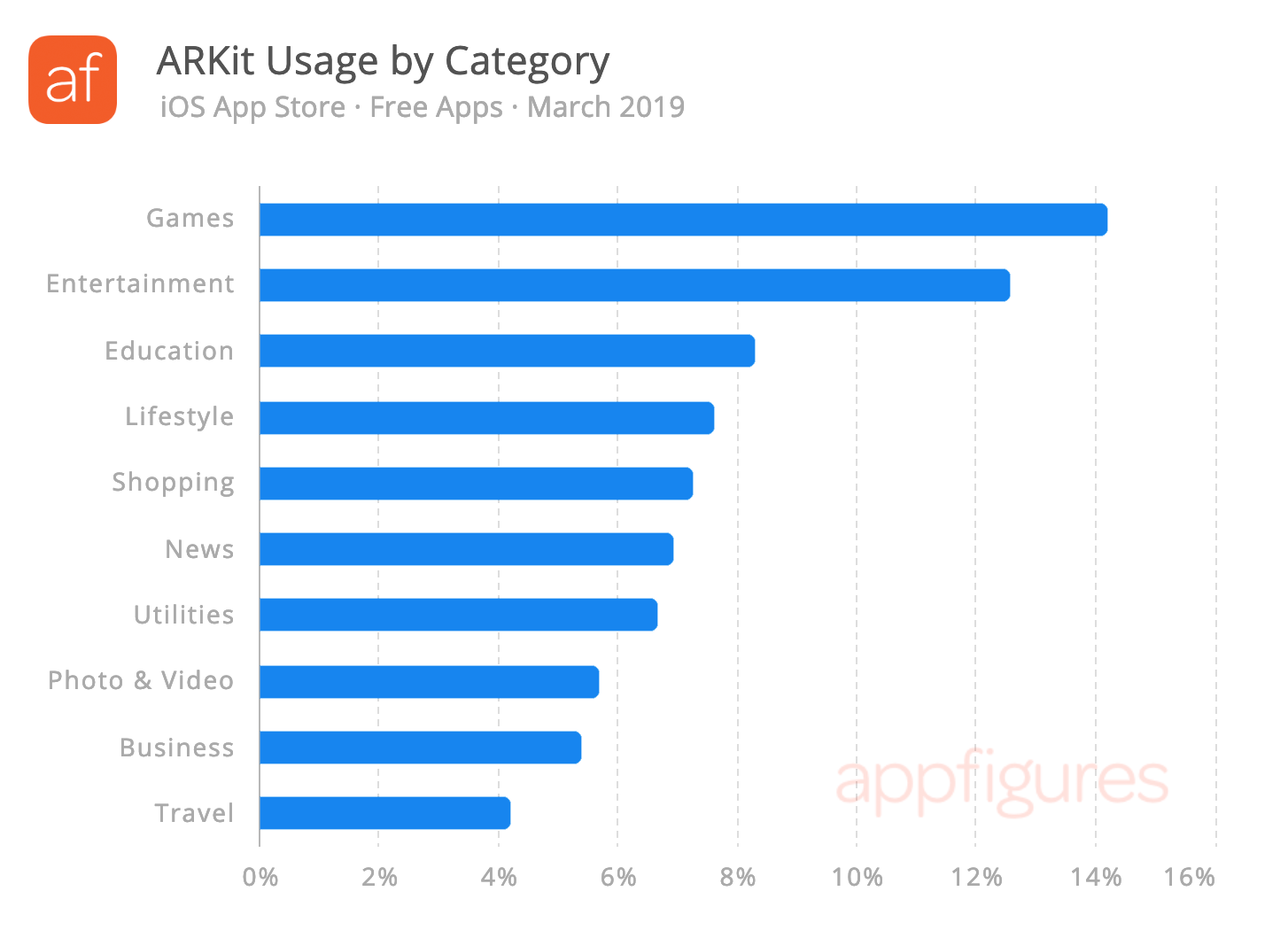

Who’s Using Apple’s ARKit (2019)?

Apple has been putting a lot of effort into ARKit since its release in 2017. According to our latest technology scan, more than 1,000 already use it. See which categories adopted this new tech in our latest report.

Apple has been putting a lot of effort into ARKit since its release in 2017. According to our latest technology scan, more than 1,000 already use it. See which categories adopted this new tech in our latest report.Read

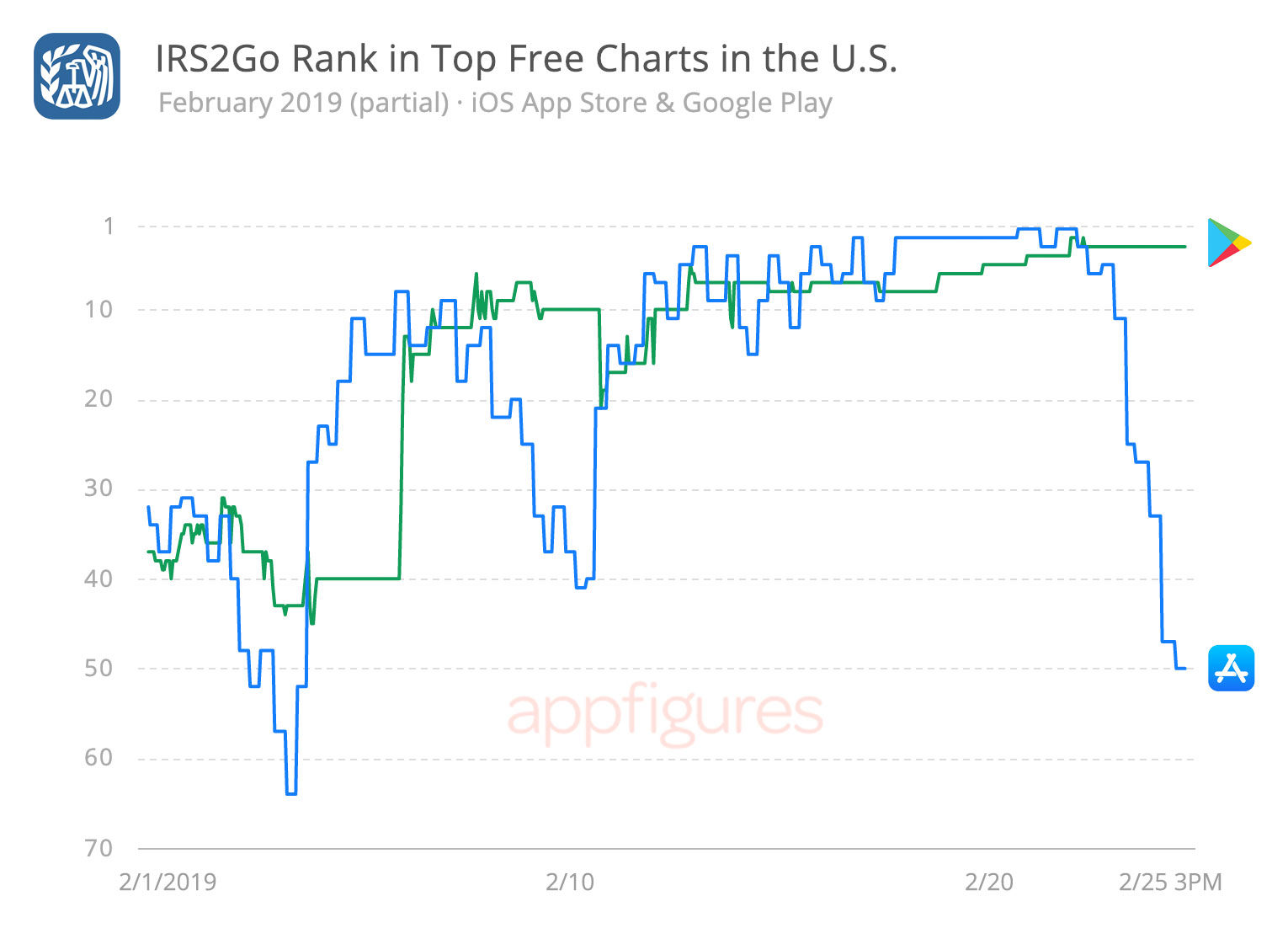

The Time The U.S. Government Took Over The App Store & Google Play

Did you know the IRS has a mobile app? Last week IRS2Go, an app from the IRS to check tax refund status, has reached a milestone. For the first time ever, the app ranked #1 in the U.S. In this flash report we're taking a closer look at the app's perfromance and downloads on the iOS App Store and Google Play.

Did you know the IRS has a mobile app? Last week IRS2Go, an app from the IRS to check tax refund status, has reached a milestone. For the first time ever, the app ranked #1 in the U.S. In this flash report we're taking a closer look at the app's perfromance and downloads on the iOS App Store and Google Play.Read

Microsoft Goes All-In On React Native For Their Mobile Apps

Microsoft has been in love with React, an open-source library from Facebook for building user interfaces, for quite some time. In addition to building an open-source library for cross platform UIs, this summer they started using React for their web …

Microsoft has been in love with React, an open-source library from Facebook for building user interfaces, for quite some time. In addition to building an open-source library for cross platform UIs, this summer they started using React for their web …Read

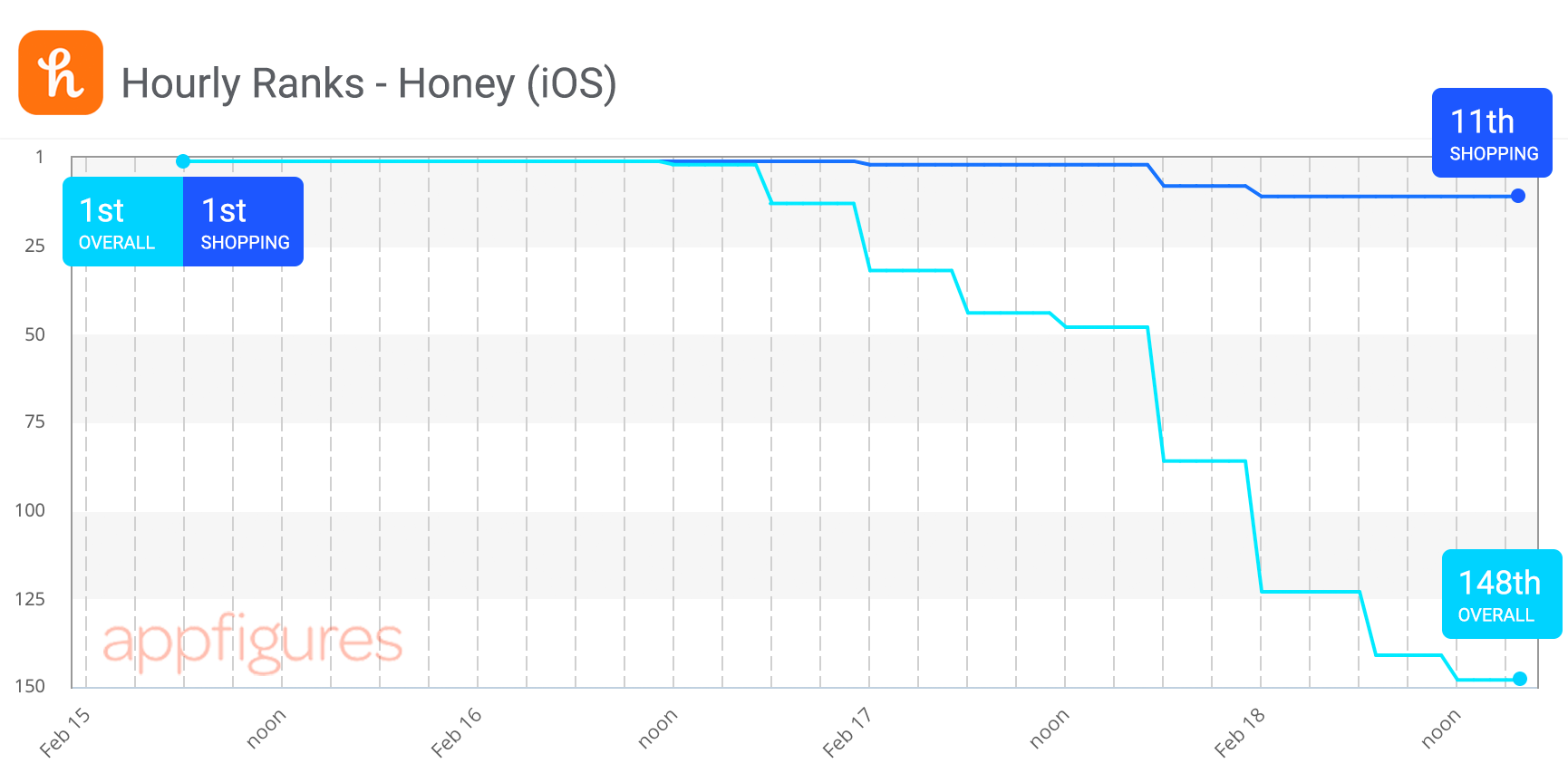

Honey Comes and Goes – A Lesson In App Marketing

Last Friday Honey, a service that finds discounts and promo codes for everyday products, launched an app to the App Store and it took it by storm storm, raising to the #1 Free app in the U.S. Here’s what getting …

Last Friday Honey, a service that finds discounts and promo codes for everyday products, launched an app to the App Store and it took it by storm storm, raising to the #1 Free app in the U.S. Here’s what getting …Read

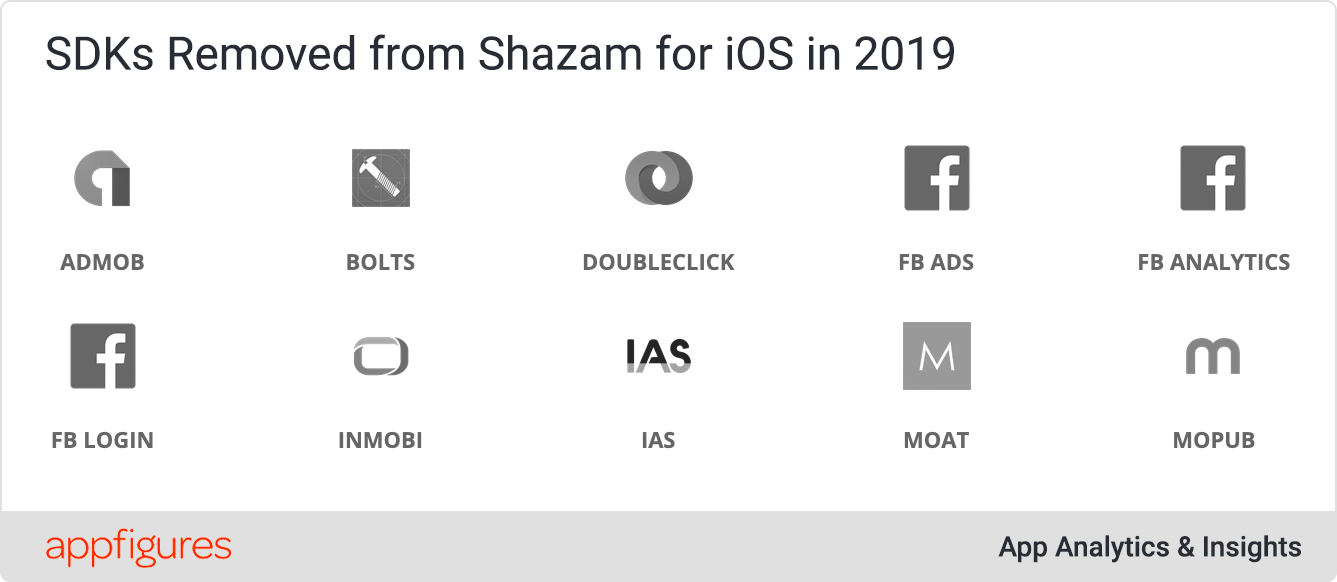

Shazam for iOS Sheds 3rd Party SDKs

Shazam, the song identification app Apple bought for $400M, recently released an update to its iOS app that got rid of all 3rd party SDKs the app was using except for one. The SDKs that were removed include ad networks, …

Shazam, the song identification app Apple bought for $400M, recently released an update to its iOS app that got rid of all 3rd party SDKs the app was using except for one. The SDKs that were removed include ad networks, …Read

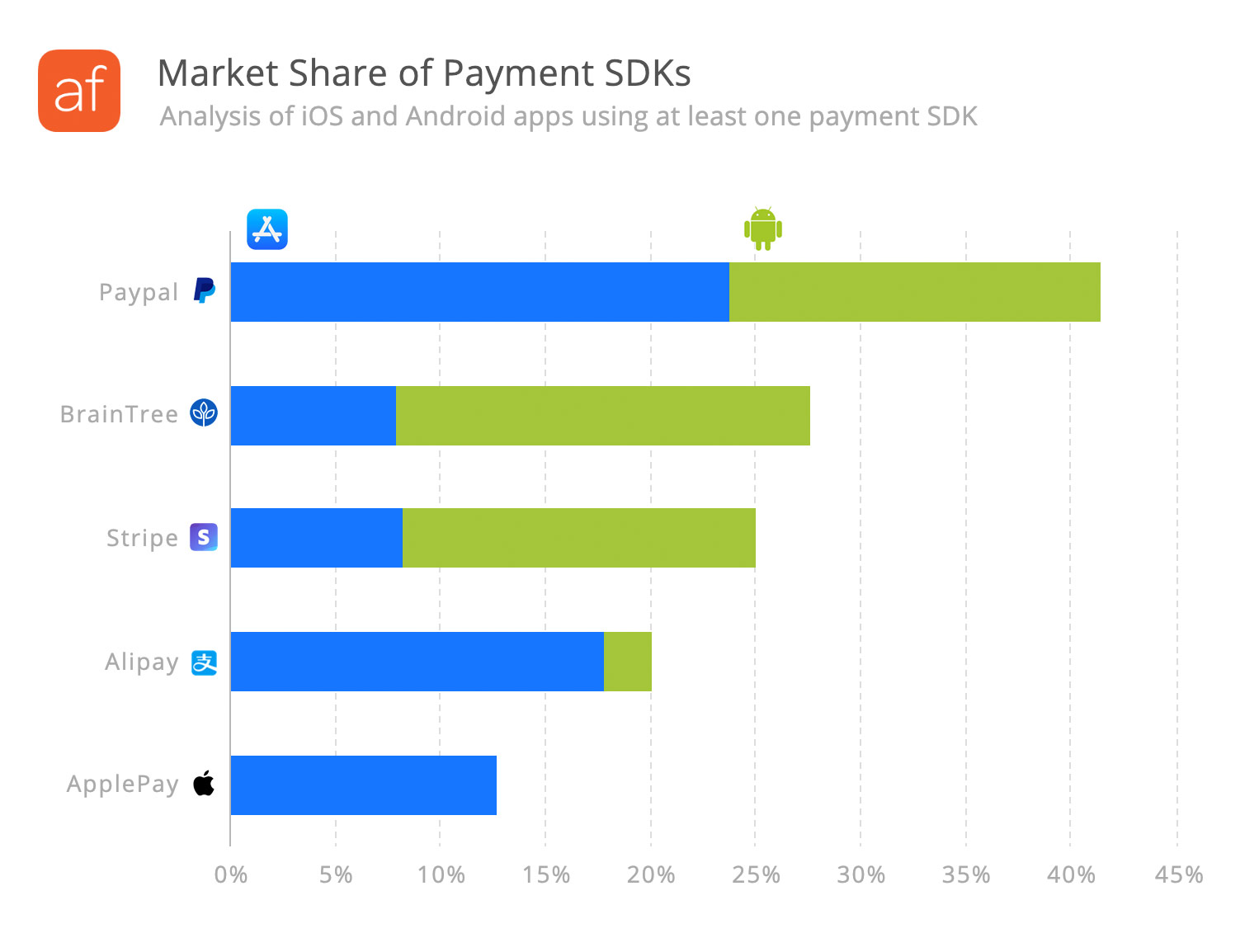

Square Takes On PayPal With Its New In-App Payments SDK

Earlier this month, Square introduced a new SDK that enables mobile developers to accept credit card payments right in their app. Just like everything Square does, the integration seems very simple and it includes many features to make the payment …

Earlier this month, Square introduced a new SDK that enables mobile developers to accept credit card payments right in their app. Just like everything Square does, the integration seems very simple and it includes many features to make the payment …Read

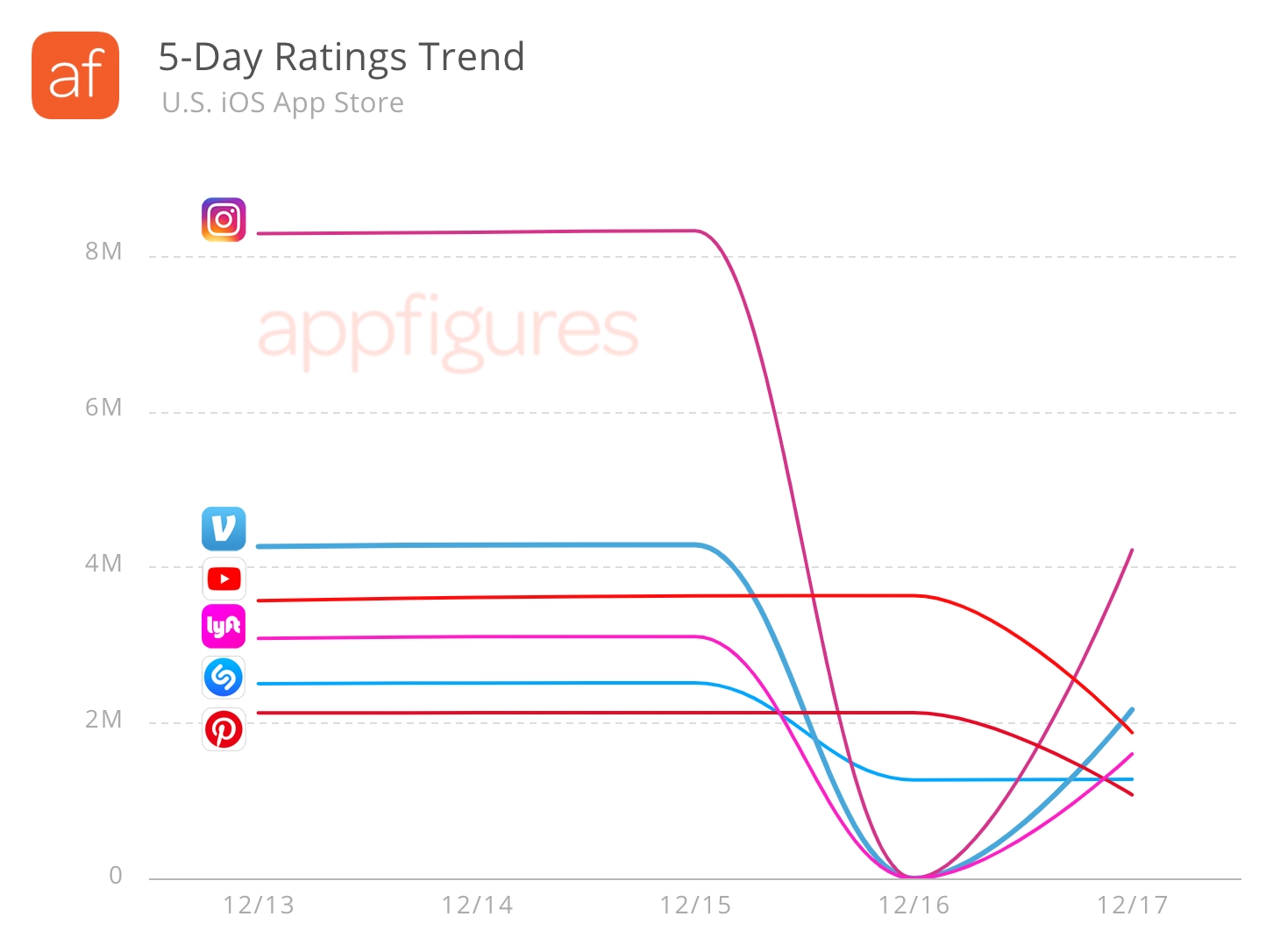

Thousands of iOS Apps Lost Half of Their Ratings This Weekend

Update: It seems Apple is in the process of updating ratings for all apps, indicating this was just a temporary bug. Over the weekend thousands of iOS apps saw a massive drop in numbers of ratings in the US. Apple …

Update: It seems Apple is in the process of updating ratings for all apps, indicating this was just a temporary bug. Over the weekend thousands of iOS apps saw a massive drop in numbers of ratings in the US. Apple …Read